Mutual fund cost basis calculator

To use this method. Total the cost of all the shares you own in a mutual fund.

Cost Basis Calculator

If you refer to the FIFO section above the same sale of 15 shares resulted in a cost.

. When you sell or exchange shares of mutual funds or other securities you may have a capital gain or loss that. Netbasis requires only a minimum amount of information from you to calculate your cost basis. Cost Basis Accounting and Regulations Cost Basis for Mutual Funds Beginning in tax year 2012 the IRS requires mutual fund companies and brokers to report on Form 1099-B 1 the cost basis.

Use this calculator to see how this investment strategy might work for you. The Cost Calculator takes the mystery and math. You can also research and analyze.

Divide that result by the total number of shares owned to get the average basis per share. If you kept all your statements you can easily determine your cost basis by adding up the original purchase cost and all the dividends that were reinvested. Investors can calculate the cost basis of a mutual fund sale redemption by using an accounting method called the first in first out FIFO method.

Stock or mutual fund. To calculate average basis. This gives you your average per share.

Starting Amount Years to Invest Additional Contributions Hypothetical Annual Rate of Return This calculator. How many years do you plan to hold the fund. Divide the total amount invested by the total number of shares in your mutual fund account.

You receive a dividend of 090 a share and you stand to receive 45. You then reinvest your dividend in the same fund at a current price of 15 which means you have bought 3 more. Divide that result by the total number of shares you own.

Up to 10 cash back Calculate accurate basis-in seconds. With BasisPro you can calculate complete cost basis of any US. The total total cost basis for the 15 shares sold would be 10 x 120 5 x 100 or 1700.

If some statements are missing you. Mutual Fund Basis Calculator Determine your gain or loss on mutual fund transactions using average cost basis method Mutual Fund Average Cost Basis Calculator Enter each purchase. After identifying the original security you acquired you just need to enter the following.

The Mutual Fund Cost Calculator enables investors to easily estimate and compare the costs of owning mutual funds. Multiply that number by. Cost basis is the original monetary amount paid for shares of a security.

Add up the cost of all the shares you own in the mutual fund. For example type 10 and press ENTER on your computer. The result is the cost.

This total is your dollar cost basis in the mutual fund.

How Do Municipal Bonds Work Learn The Basics Bond Basic Investing

What Nris Need To Know About Investing In Mutual Funds In India Welcomenri

Akash Works With An It Conglomerate As A Consultant And His Career Spans A Decade Two Years Ago When He Had Accumulat Home Buying Home Loans Financial Goals

Suryoday Bank Ipo Review Check Gmp Financials Details Price Lot In 5 Easy Steps Bank Financial Investing

Return On Capital Employed Roce In 2022 Return On Capital Financial Analysis Cost Of Capital

Portfolio Dividend Tracker Build Yours In 6 Steps Dividend Investing Dividend Income Dividend

Pin On Portfolio The Entrepreneur S Cfo

How To Invest In Stocks A Step By Step For Beginners Nerdwallet Investing In Stocks Stock Trading Investing

Guide To Calculating Cost Basis Novel Investor

Actionable 100 Year Analysis Of S P 500 What S The Best Strategy To Maximize Returns Strategies Investing Stock Market

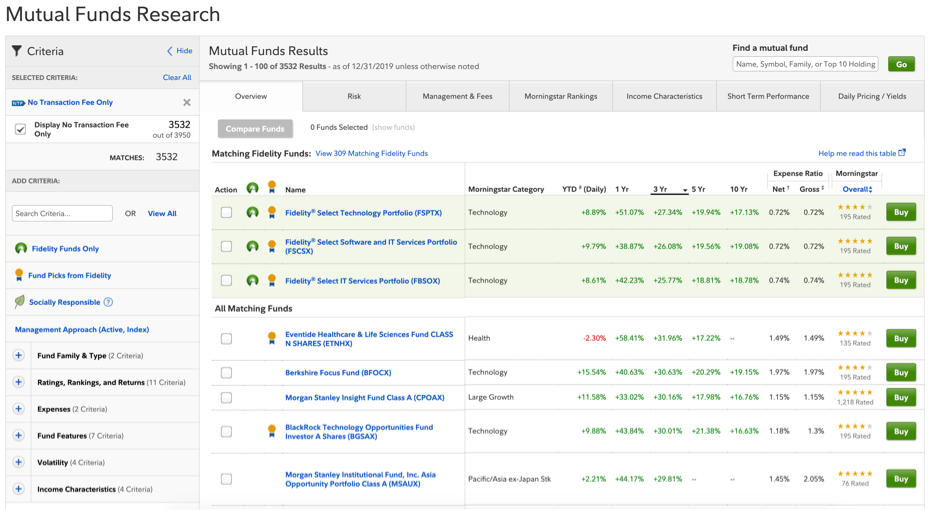

Stock Screeners Fund Comparison Tools From Fidelity

Ktm Sales In India Grew By A Staggering 37 In Fy2020 Stock Market Investing Stock Market Capital Market

All Types Of Funds Decoded Mutuals Funds Fund Mutual

Etf Vs Index Funds Top 8 Differences You Must Know Stock Exchange Index Fund

Prime Cost Overheads Theories Paperback

Currency And The Roman Empire Roman Empire Financial Institutions Financial Literacy

Tzkpm21q V6irm